| ADD A FEATURE

TAXACT

Implementing features on an existing tax platform to make the filing process easier for users.

Overview

TaxAct is a tax preparation software that helps individuals and businesses prepare and file their federal and state income tax returns. It is designed to simplify the process of tax filing by providing a user-friendly interface, step-by-step guidance, and various tools to ensure accuracy and maximize refunds.

However, users still continue to struggle with understanding tax terminology and remain confused about how to file their taxes. My goal is to design additional features that will help simplify the tax filing process for users, reducing their stress and making the user experience seamless.

ROLE

UX/UI Designer

TOOLS

Figma, Google Forms

TIMELINE

1 Month

Table of Contents

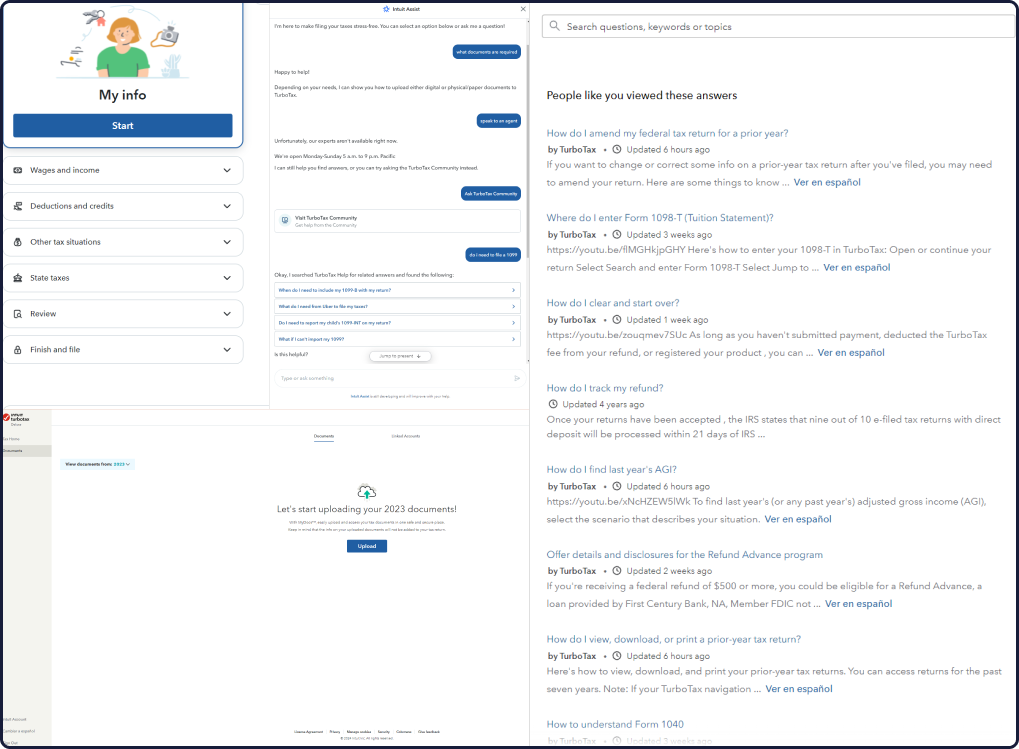

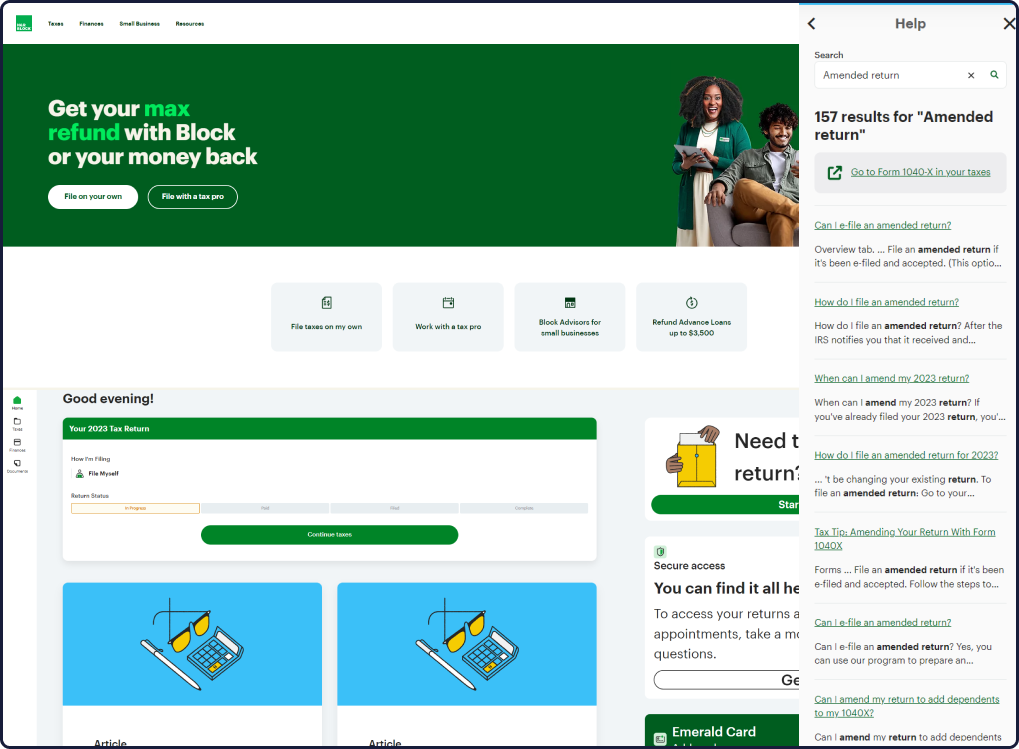

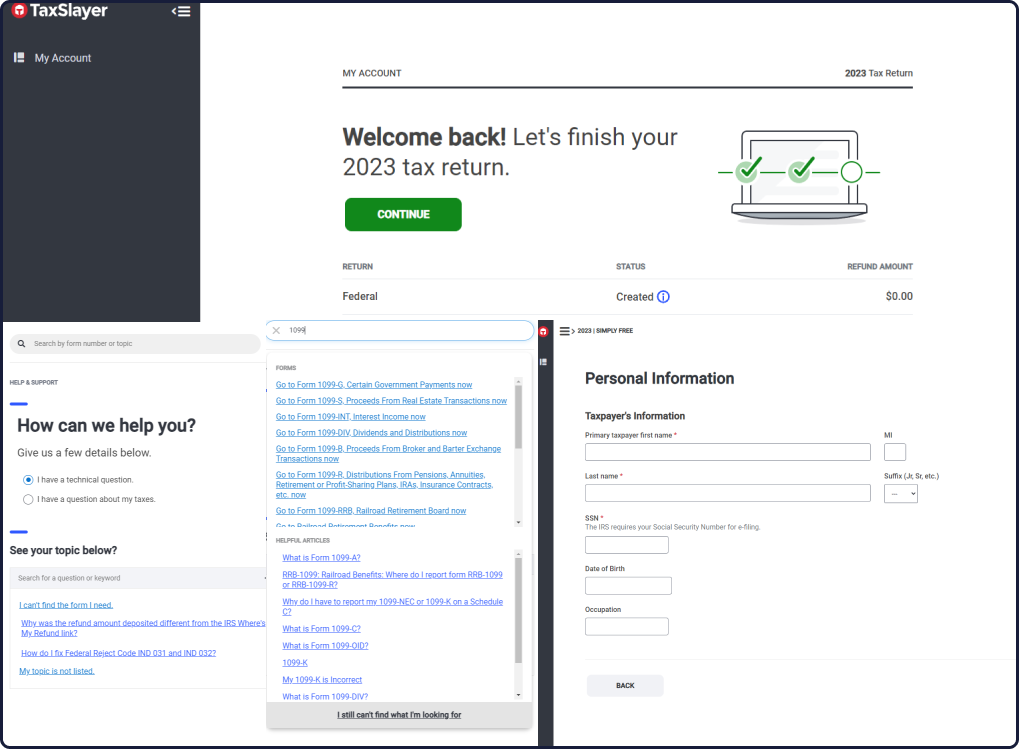

| COMPETITIVE ANALYSIS

Research Findings

Below are a few samples of strengths and weaknesses I discovered during my competitive analysis research.

TaxAct

TurboTax

H&R Block

TaxSlayer

Variety of Filing Options

Offers multiple filing methods, whether it’s for yourself, a business, or a complex return.

Easy to Follow

Guides users in the same order as the tax form they're filing and auto-fills info for returning filers.

No Mobile App

Unlike competitors, it does not offer a mobile app for easy access to returns.

Limited Support

Support offered is limited, and only offers phone call assistance within business hours, or online forums.

Clear Instructions

Offers clear prompts and explanations, making it user-friendly for beginners.

Tax Tips

Regularly updated blog and articles with tax tips and guidance to help users make informed decisions.

High Costs

Costlier than many competitors, especially for complex returns or premium features.

Paywall

Requires a fee for users who seek professional tax advise and assistance from experts.

Physical Offices

Offers face-to-face meetings with tax experts at physical offices worldwide.

Broad Service Coverage

Capable of handling various tax situations, including self-employment, investments, and small businesses.

Additional Costs

The free filing option may not include state returns, which can add unexpected fees.

Paywall

Requires a fee for users who seek professional tax advise and assistance from experts.

Import Features

Allows import of past returns from other providers and W-2 uploads, saving time and reducing errors.

Simple UI

UI is very straight-forward, no paywall, ads, or distractions.

Limited Informational Resources

While they provide basic FAQs, their resource library is not as extensive or detailed as some competitors.

Limited Guidance

Offers fewer resources and tutorials, making it harder for new users or those with complex taxes.

| SURVEY

What are the main issues users face?

I conducted a survey with 12 participants to gain a broader understanding about their tax filing experiences, the resources they rely on, and what features they use to file their taxes.

50%

participants don’t know how to file their taxes

Other 50% knew how to file their taxes, but still needed additional help by in-depth research.

65%

participants unsure what documents to use for filing

Most participants were unsure what required paperwork was needed to file, and often scrambled to gather everything last minute.

75%

participants prefer filing their taxes on a computer

While many tax companies offer mobile apps, most participants preferred using a computer to avoid errors.

| USER INTERVIEWS

Why Is Filing Taxes So Difficult?

User interviews were conducted with 8 participants to gain an in-depth understanding about their tax filing experiences, pain points, and stress-management strategies.

Affinity Mapping

I created an affinity map to highlight common patterns and pain points from each of the individuals I interviewed. After compiling and organizing the pain points from each interview, I created a list of common patterns and takeaways.

Problem Statement

Users need a way to feel confident when filing their taxes because they’re difficult to understand. They end up feeling stressed, frustrated, and overall negative about the entire tax process.

“How might we design a feature that eases the stress and negative emotions users face when filing their taxes?”

| PERSONAS

Understanding the User

Personas were created using insights collected from user interviews. I created two types of personas: the detail-oriented tax filer and the filer eager to finish quickly.

“The hardest part of filing taxes is keeping track of all the necessary paperwork.”

— User Interview

“Not sure what to fill out where; the documents all seem so confusing.”

— User Interview

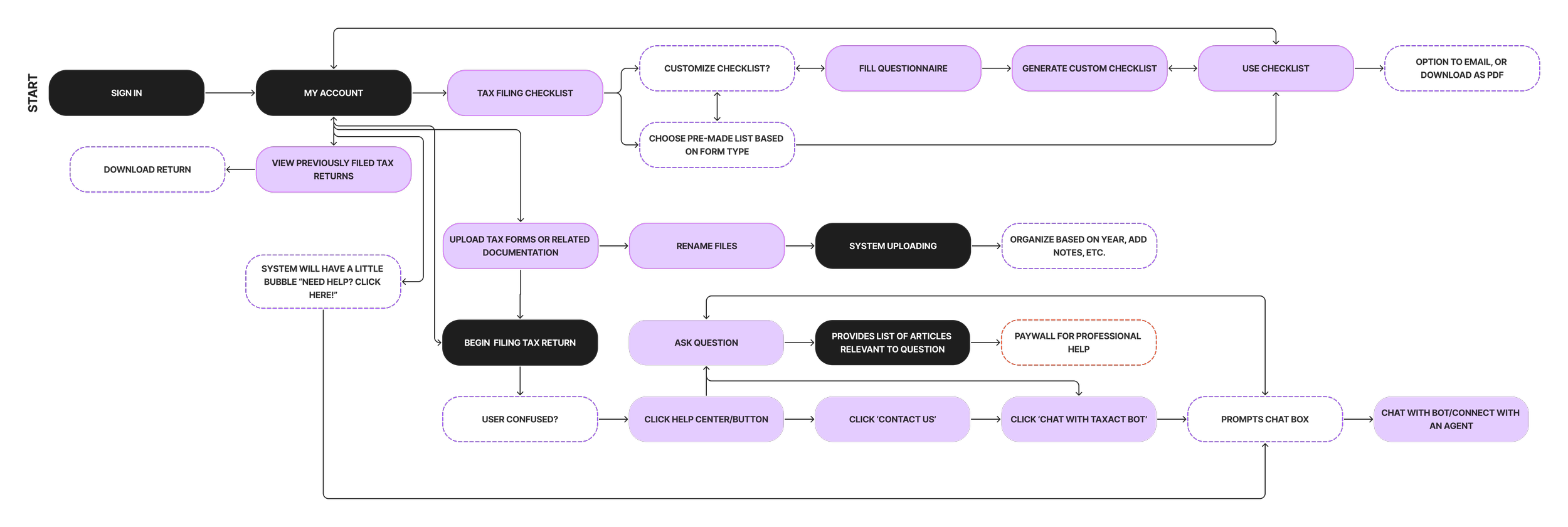

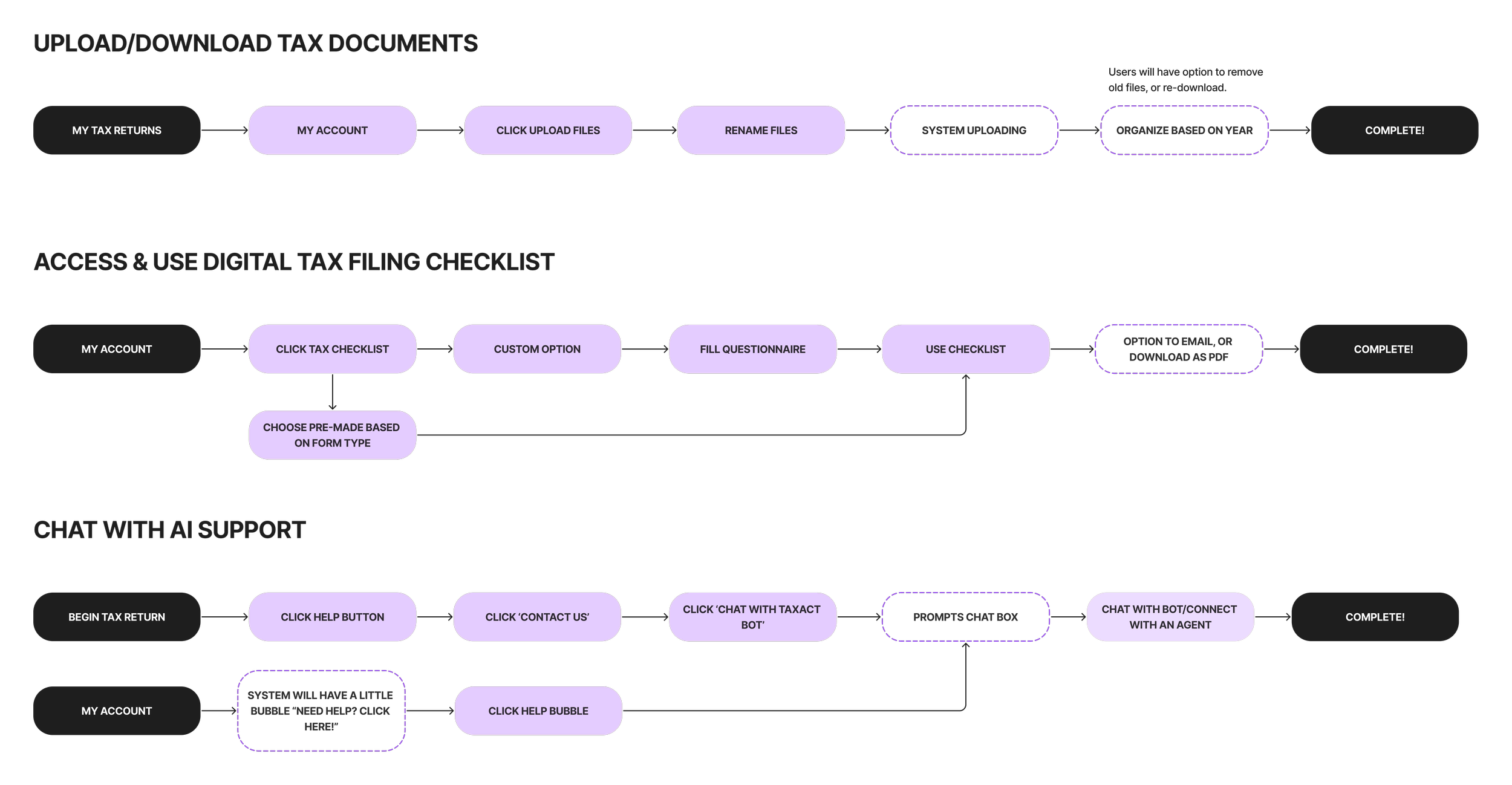

| USER FLOWS

User & Task Flows

Before beginning the wireframing process, I created user flow and task flows to map out how users would navigate the features. My goal is to outline each feature, and identify any potential roadblocks.

| LOW & MID-FIDELITY WIREFRAMES

Visualizing the User Flow

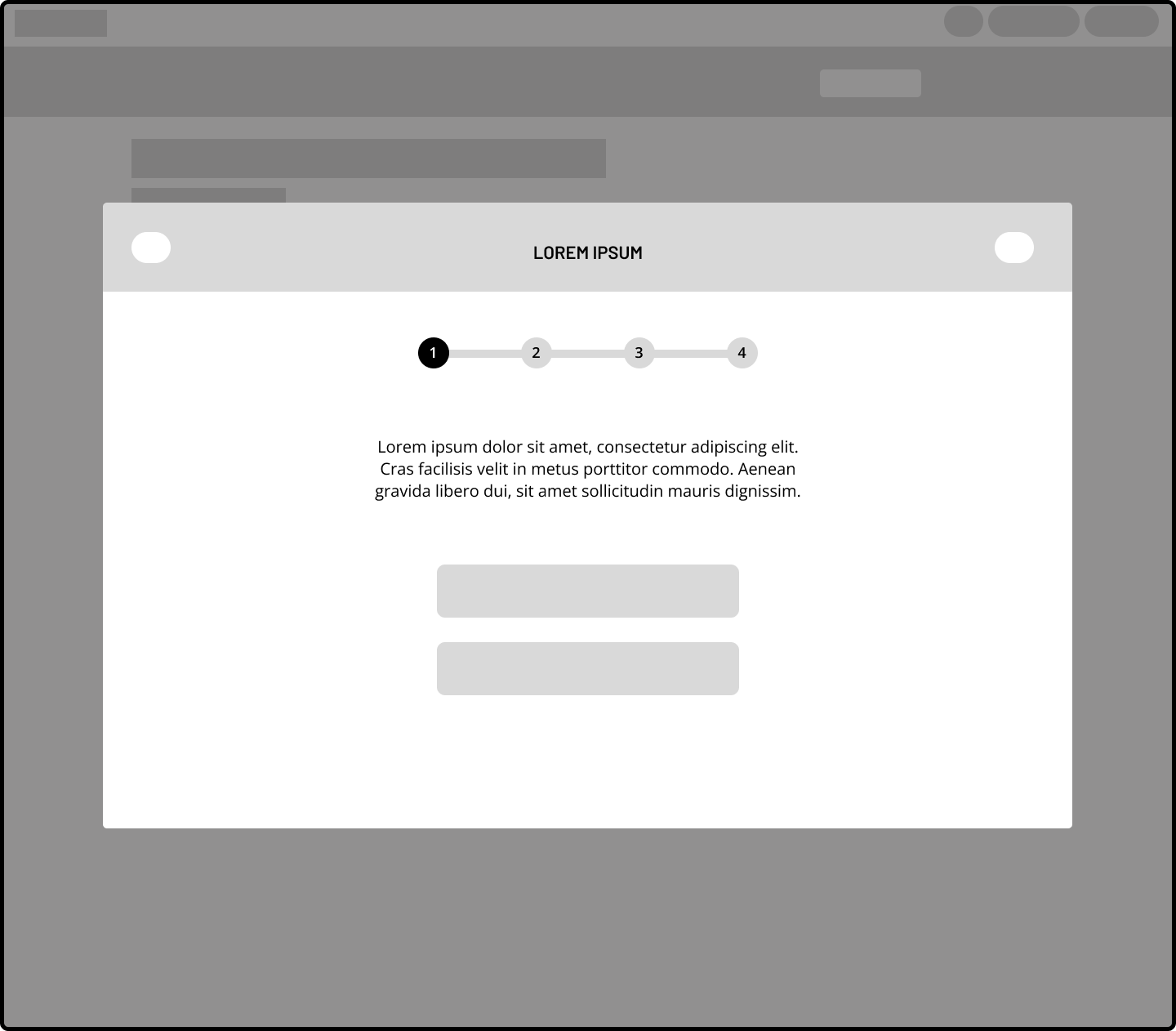

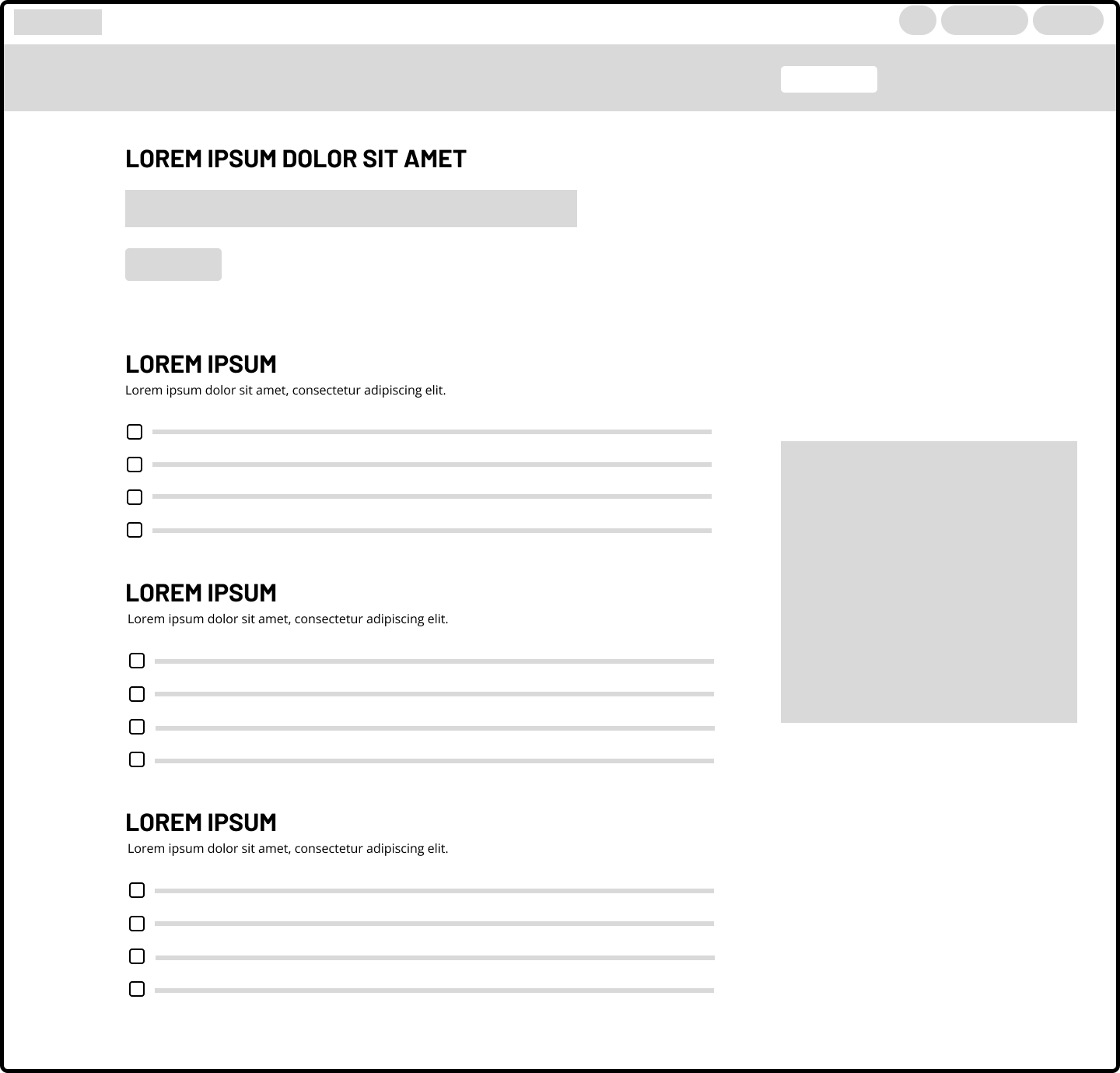

Low-Fidelity

I sketched out low fidelity wireframes for how the features would be implemented into TaxAct’s current system, and translated those sketches into draft screens in Figma.

Mid-Fidelity

After establishing the foundation, I refined the features to mid-fidelity to match TaxAct’s UI, and tested the prototype with participants from user interviews to ensure a clear, intuitive flow. These tests helped identify navigation issues, and potential pain points.

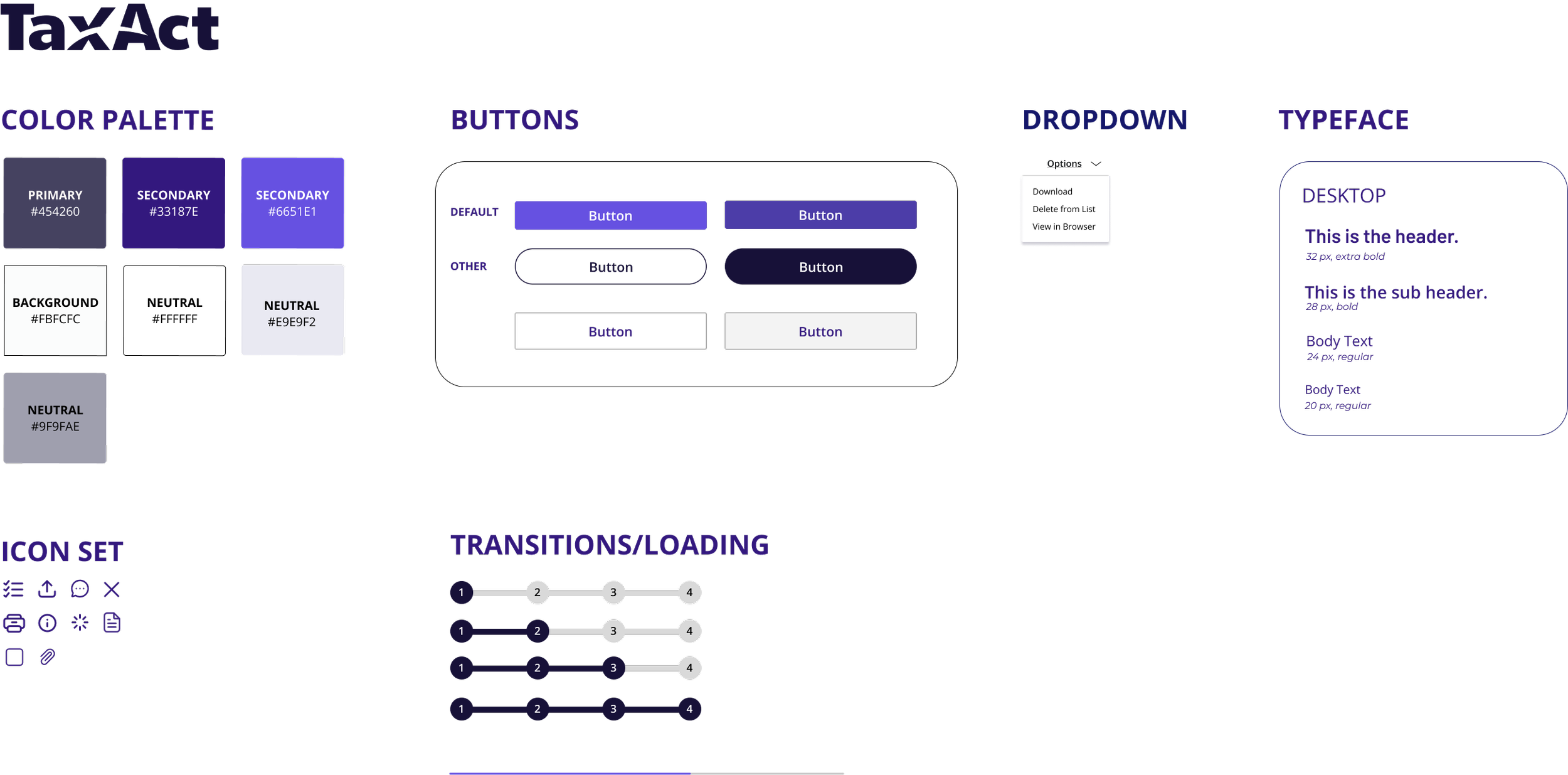

| BRANDING

Branding

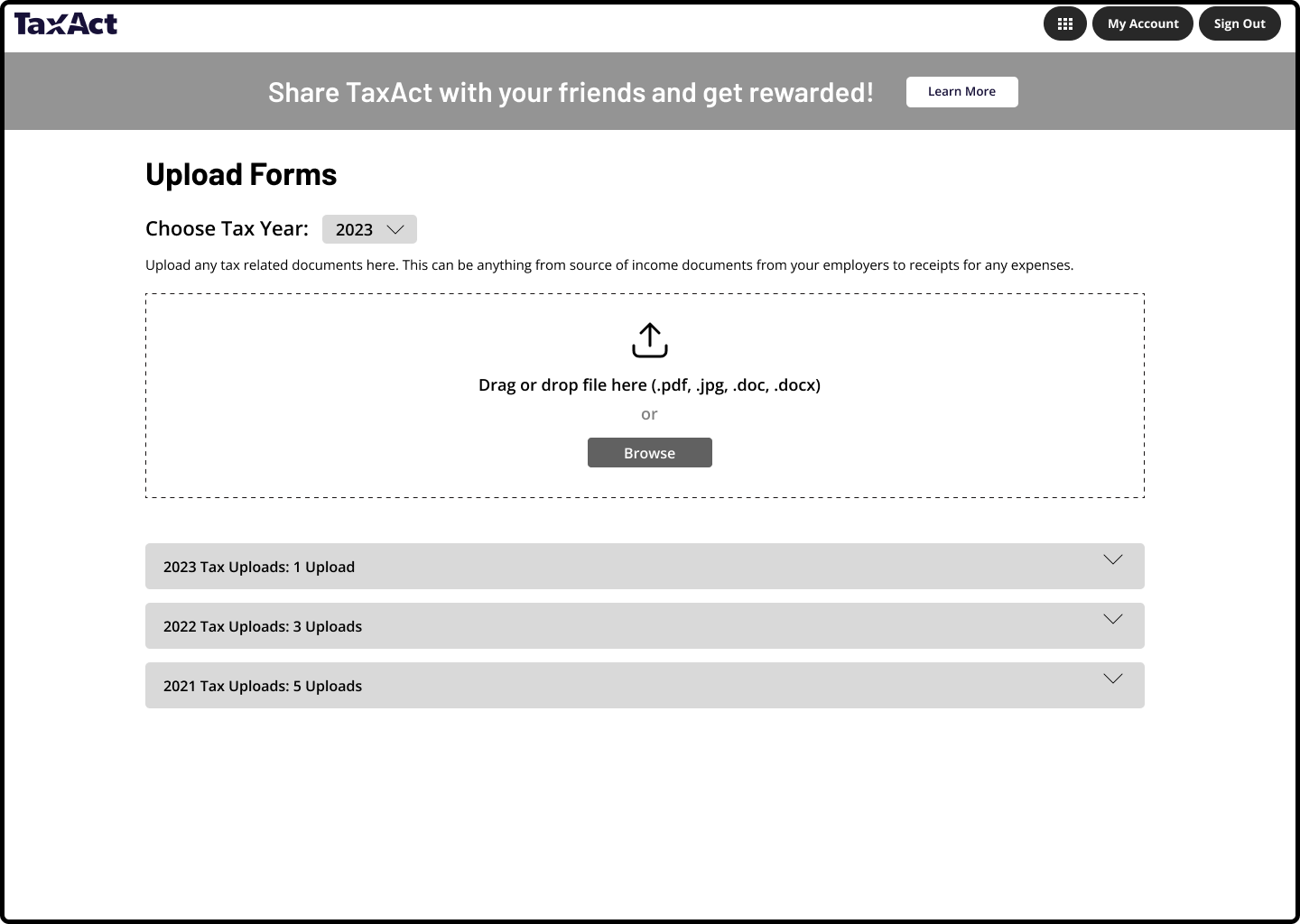

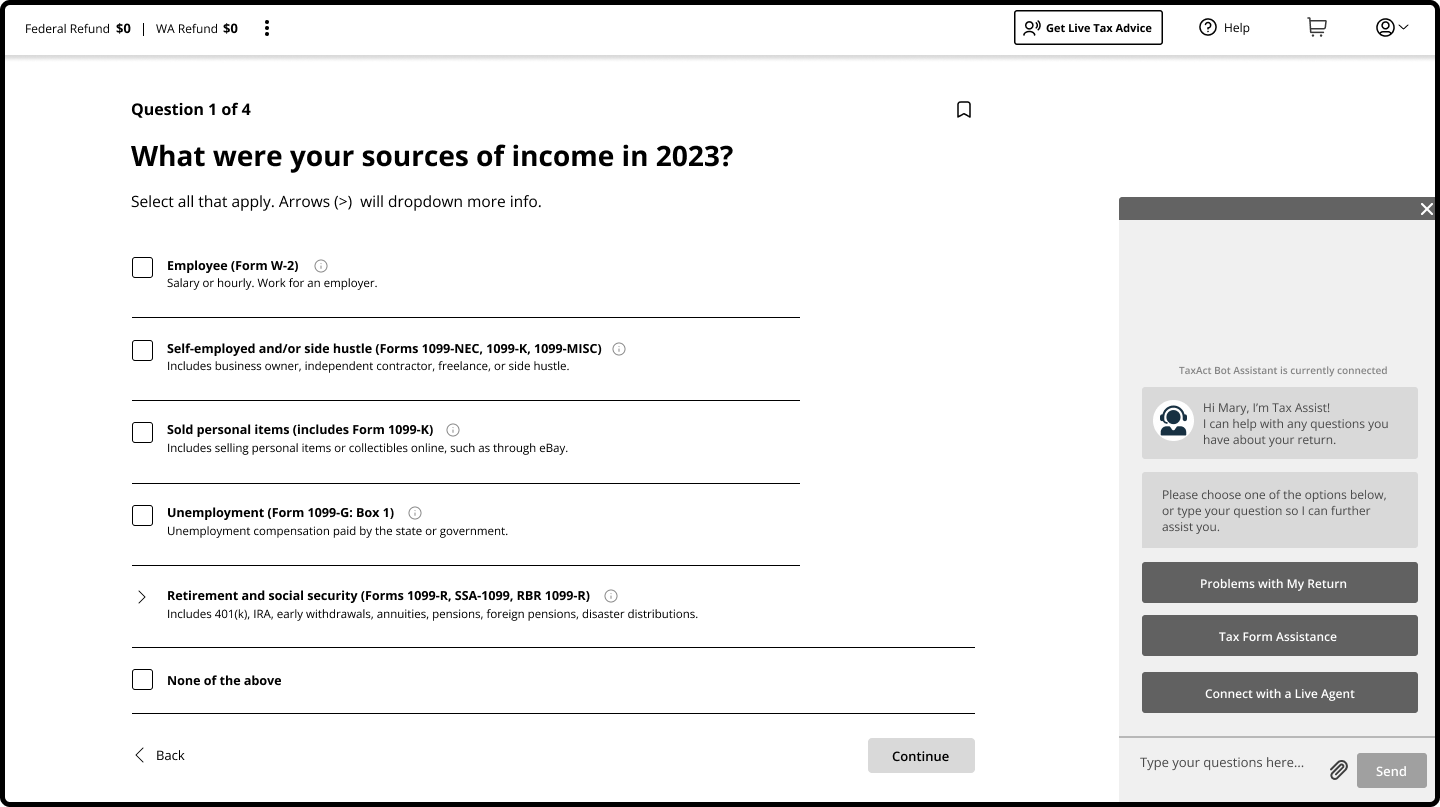

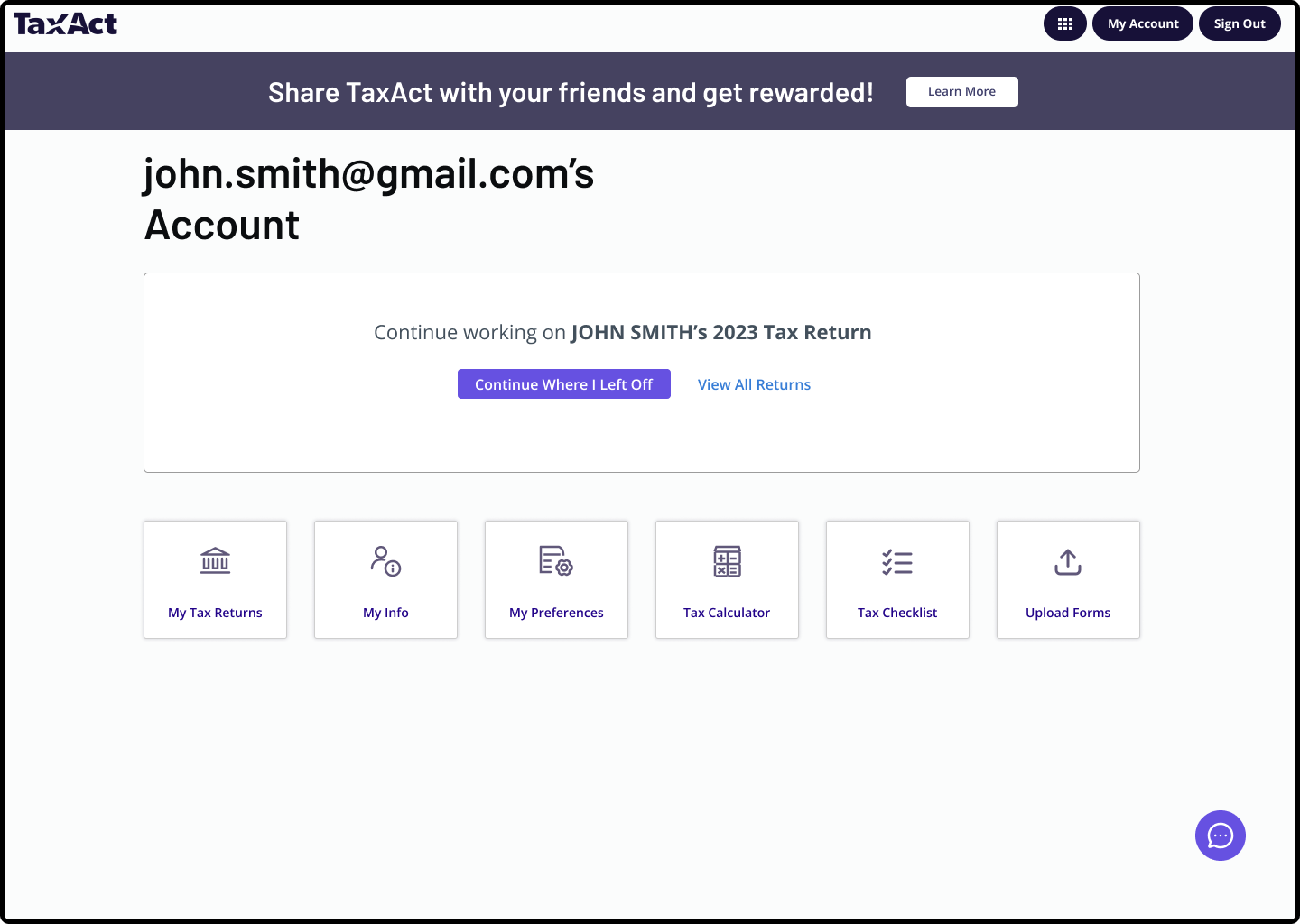

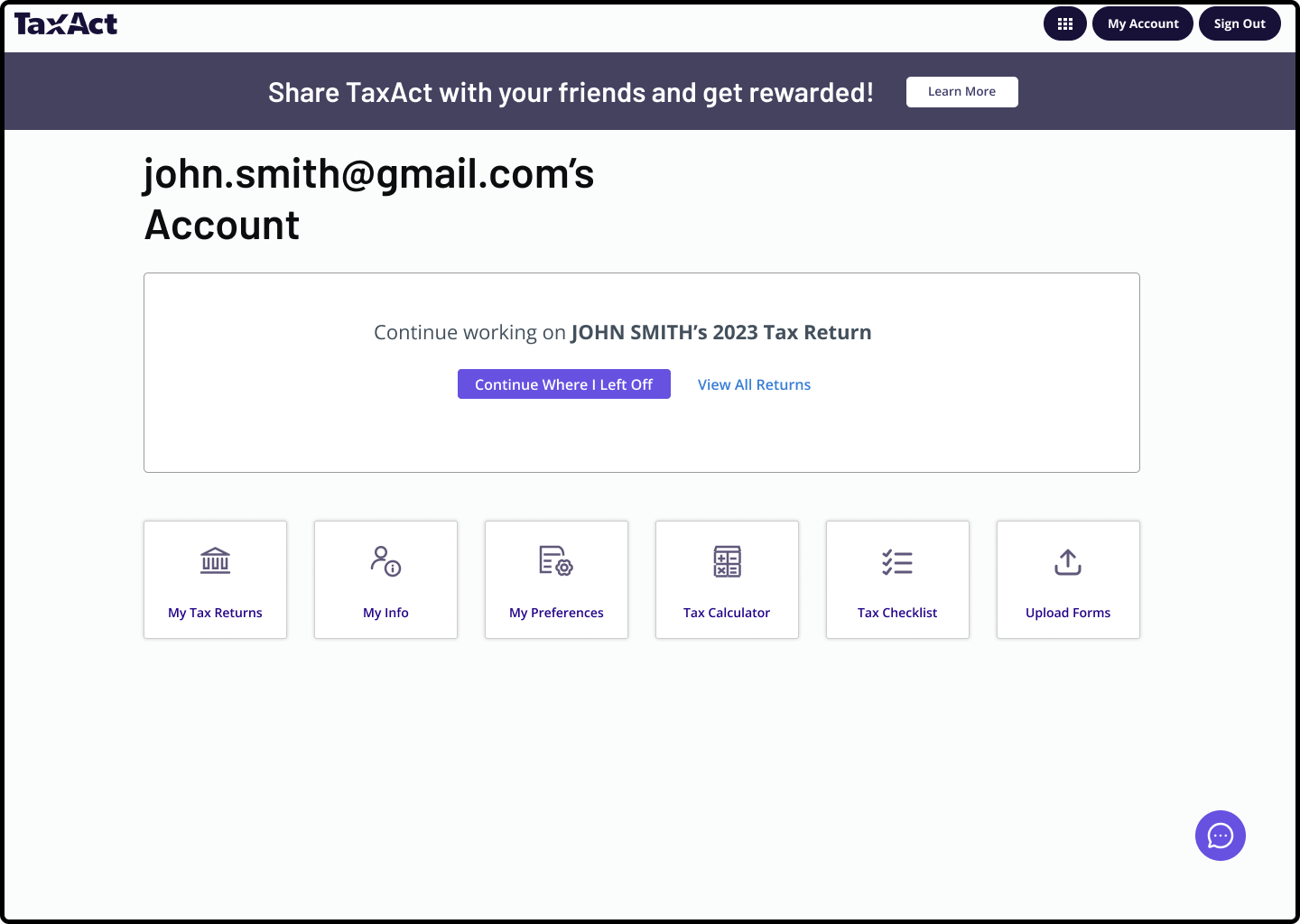

The most challenging part of the design phase was how to implement features that fit TaxAct’s UI. I referenced the actual site under my own tax account, and screenshots provided from the official site to assist me with the design process.

UI Kit

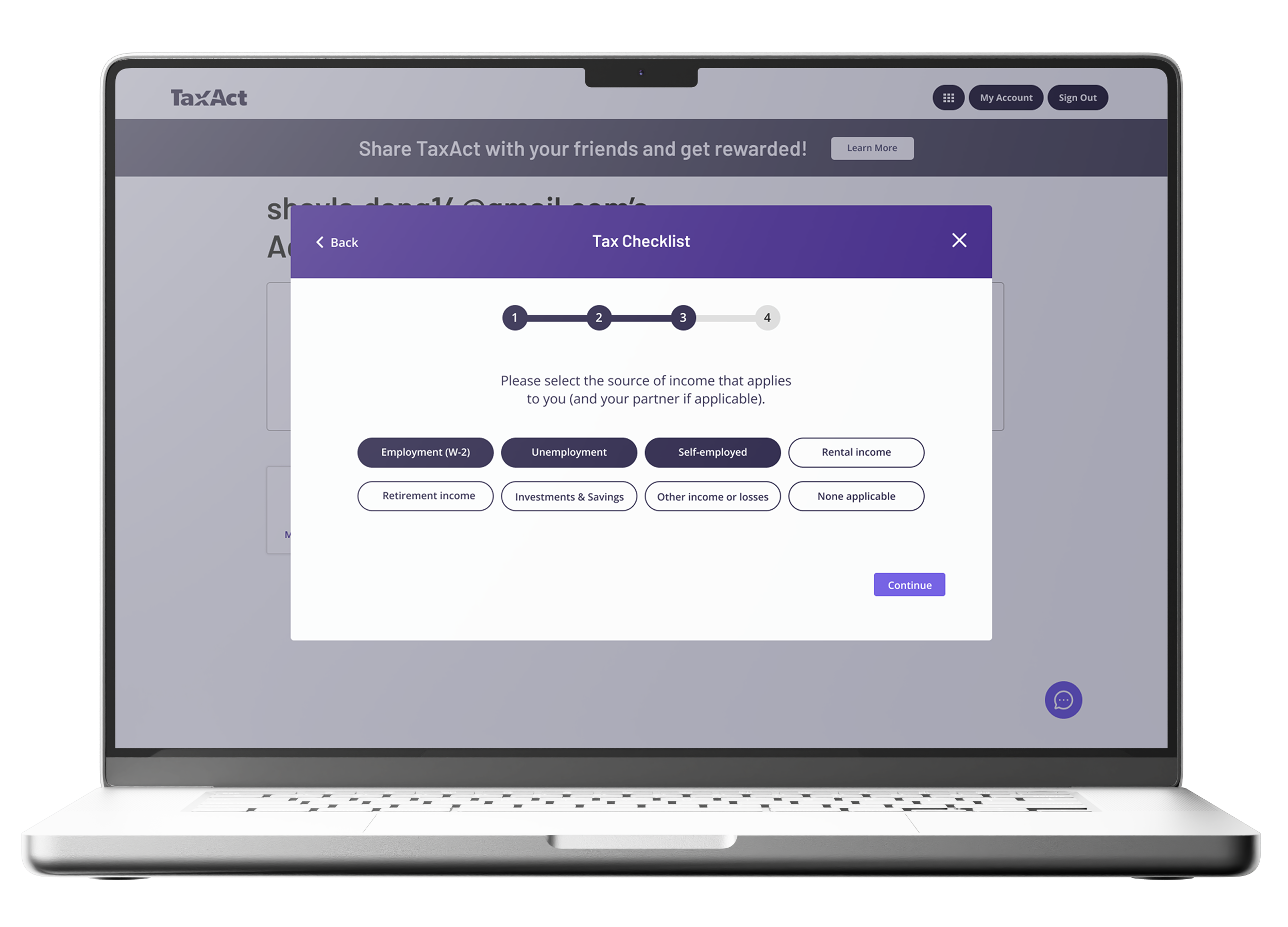

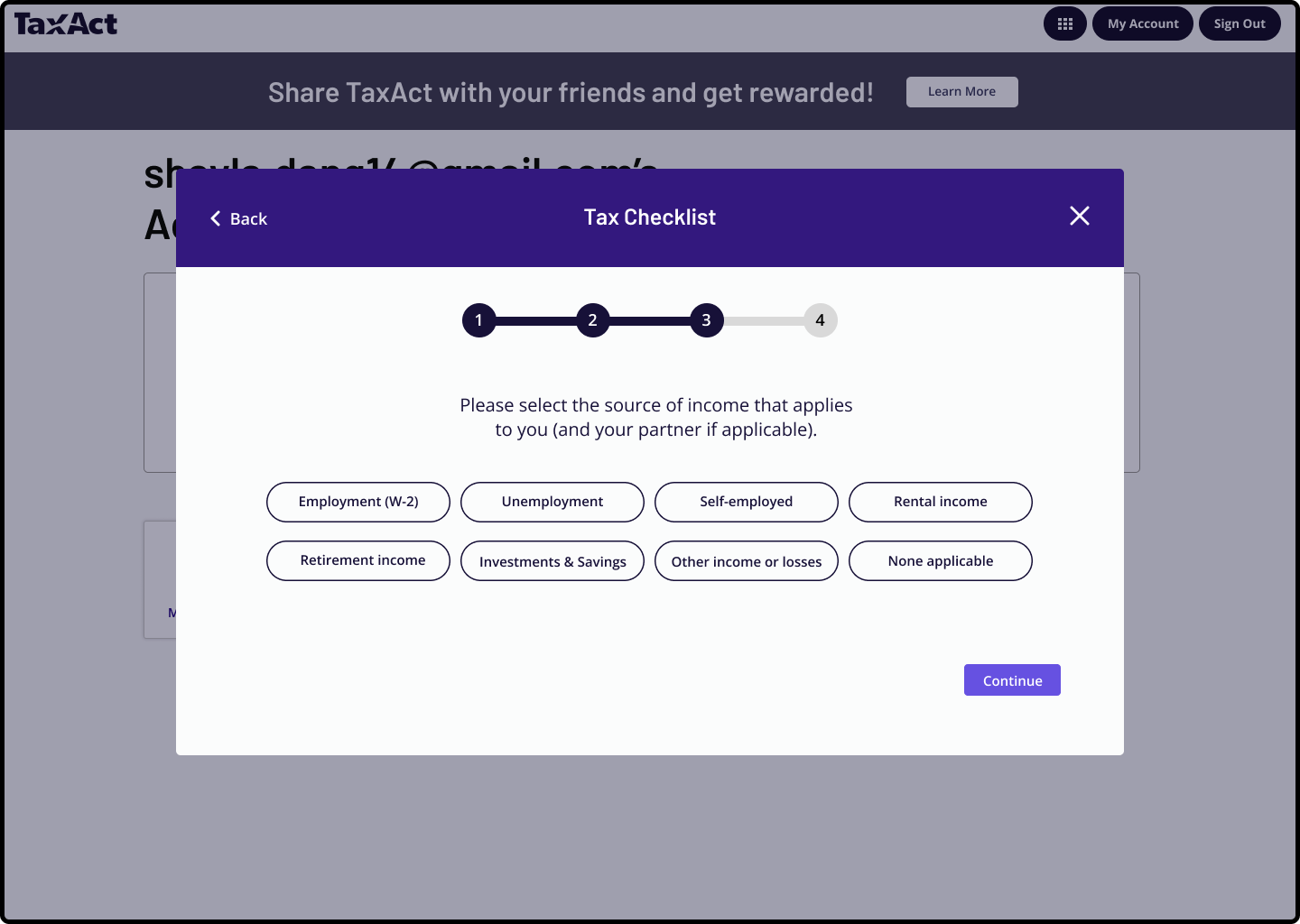

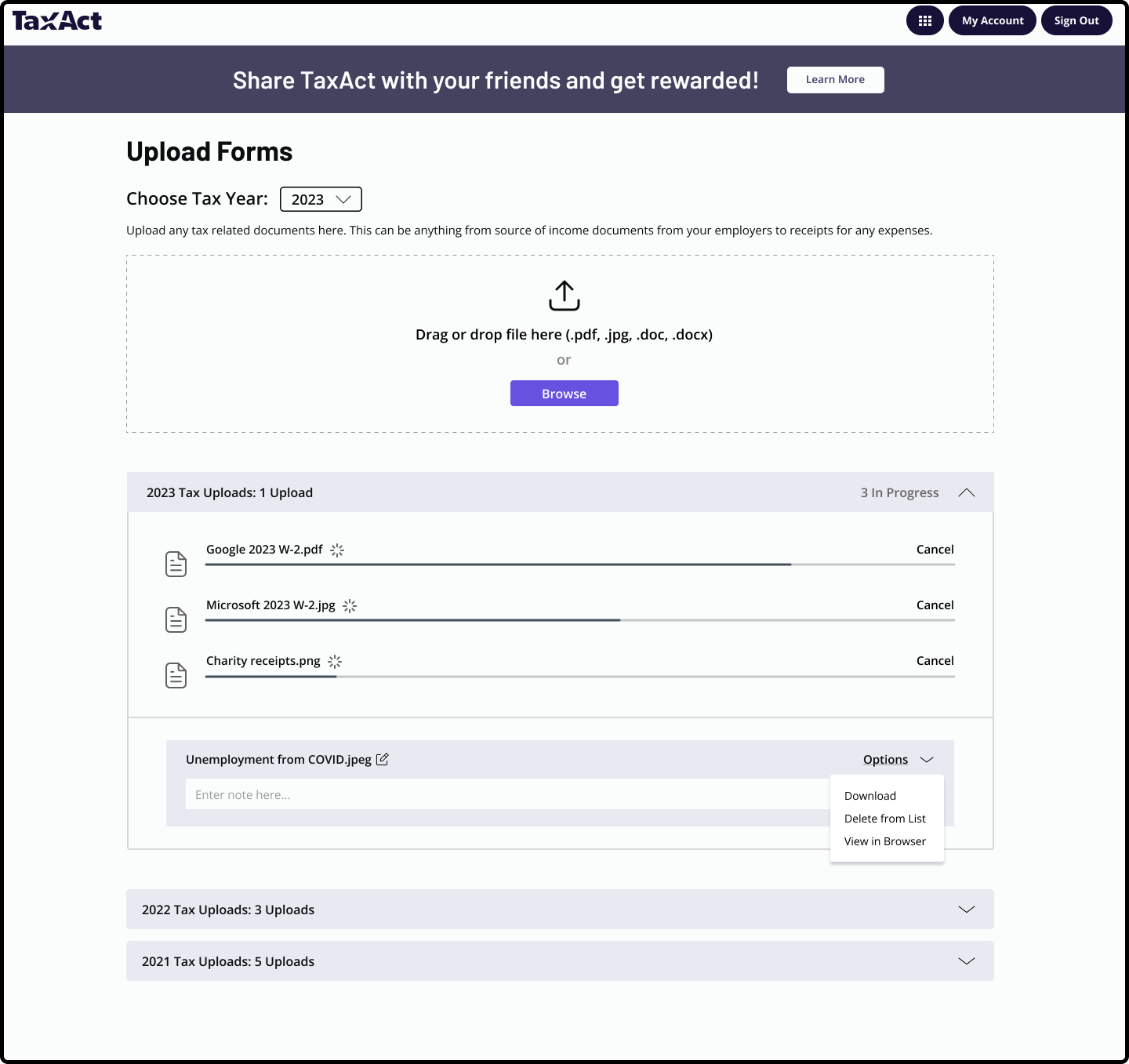

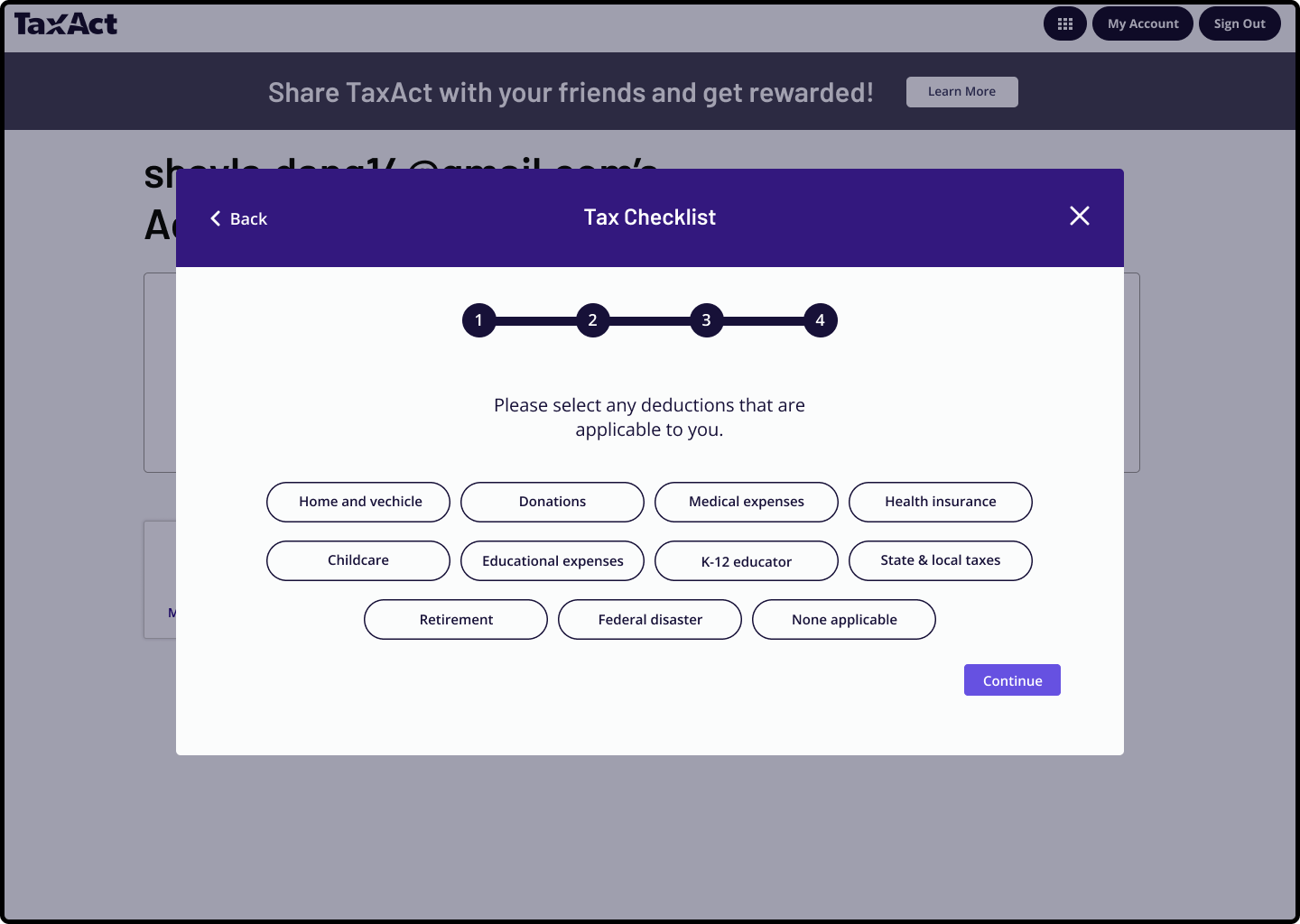

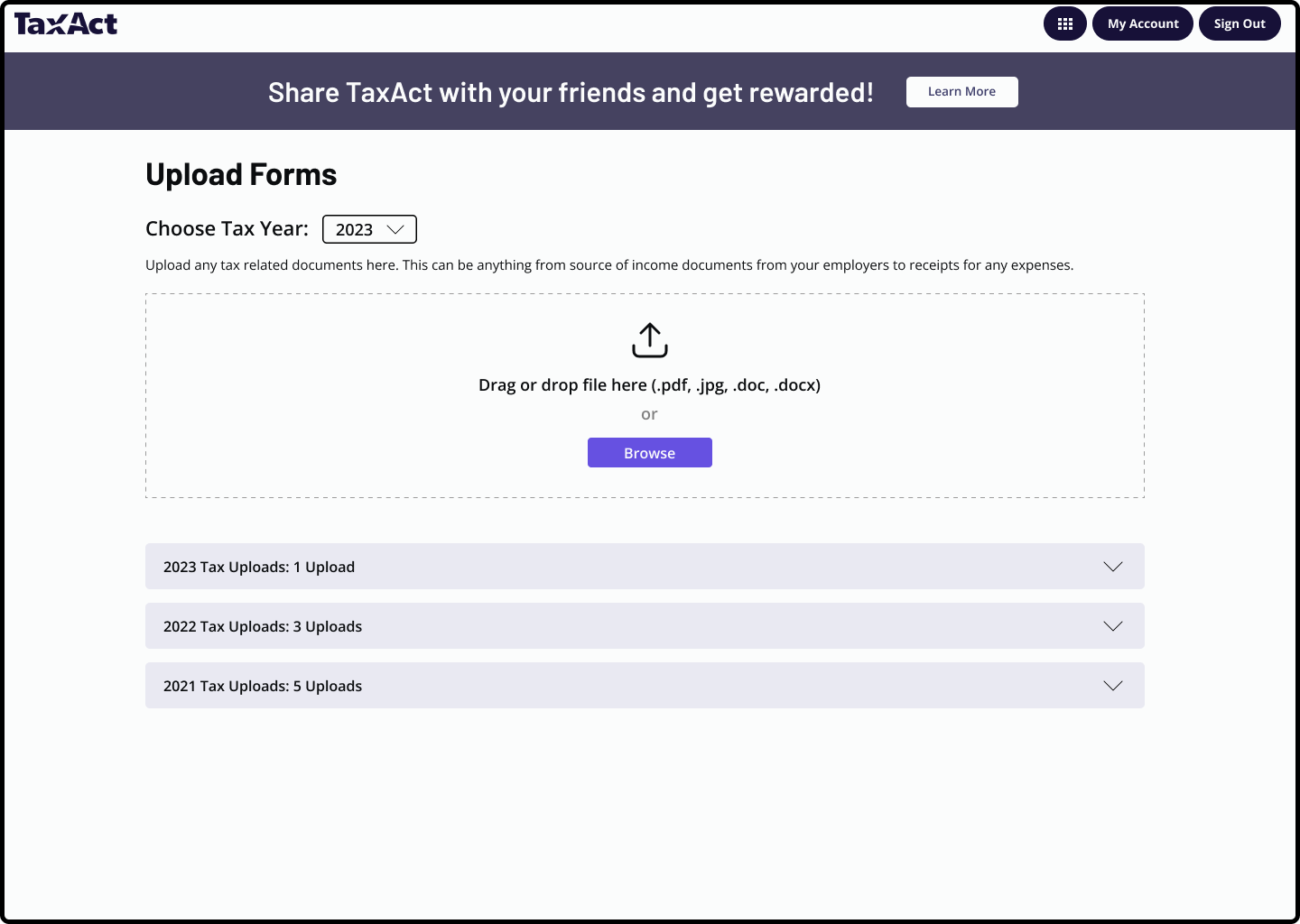

| HIGH-FIDELITY WIREFRAMES

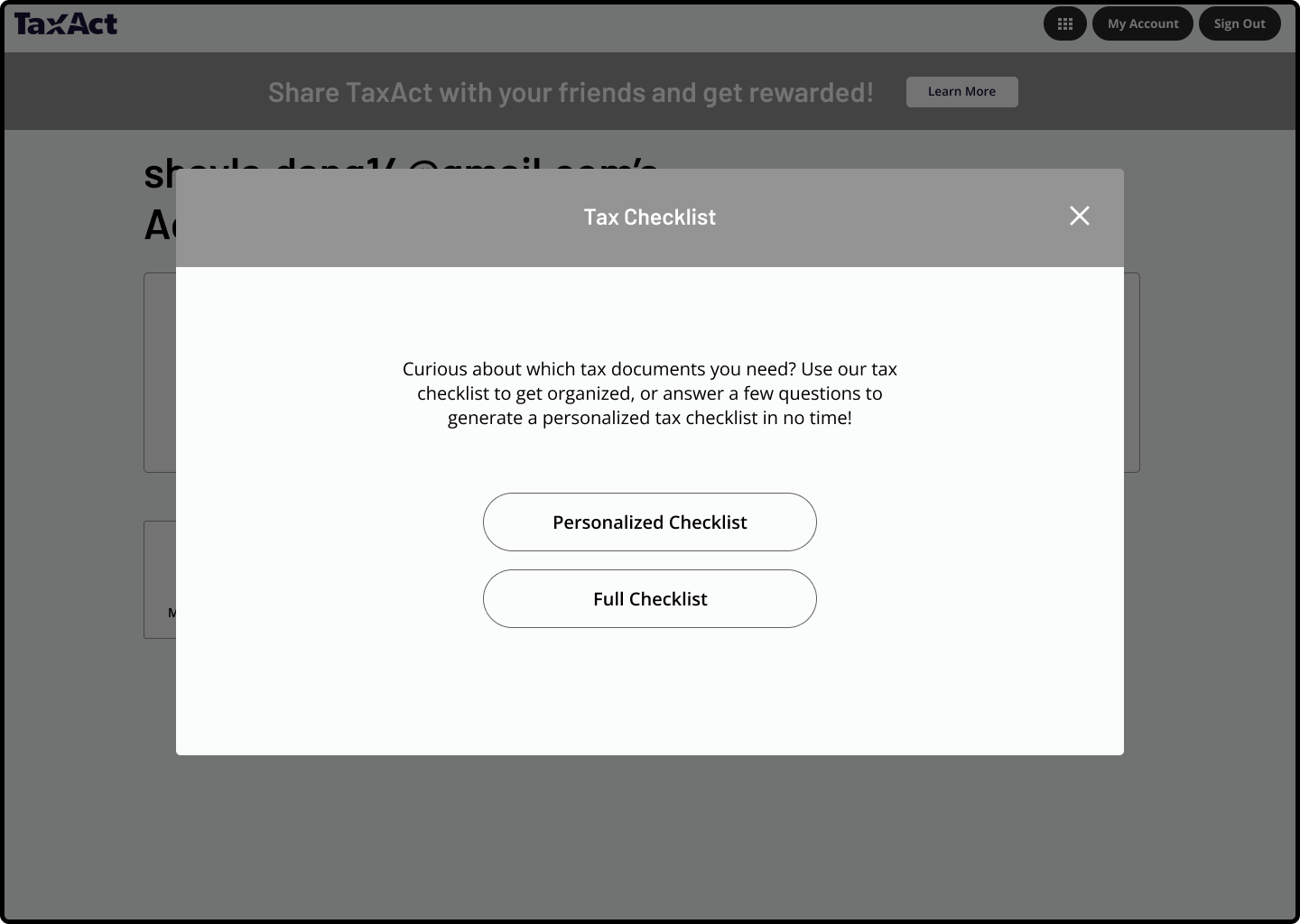

Implementing TaxAct’s UI

After making a few adjustments, I integrated the site's branding and visual design into the hi-fi wireframes. This process focused on refining the user flow and referencing TaxAct’s UI.

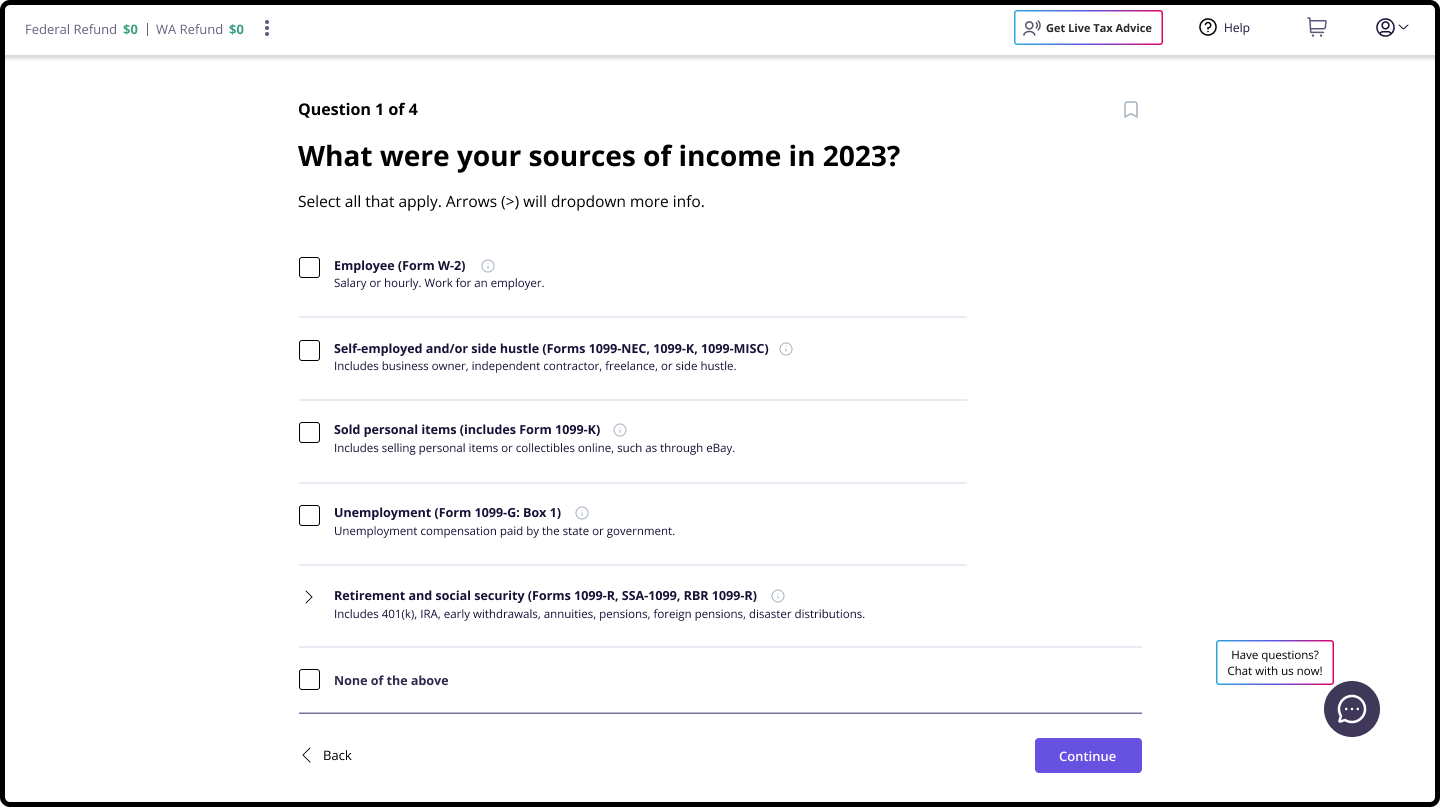

| USER TESTING

User Testing

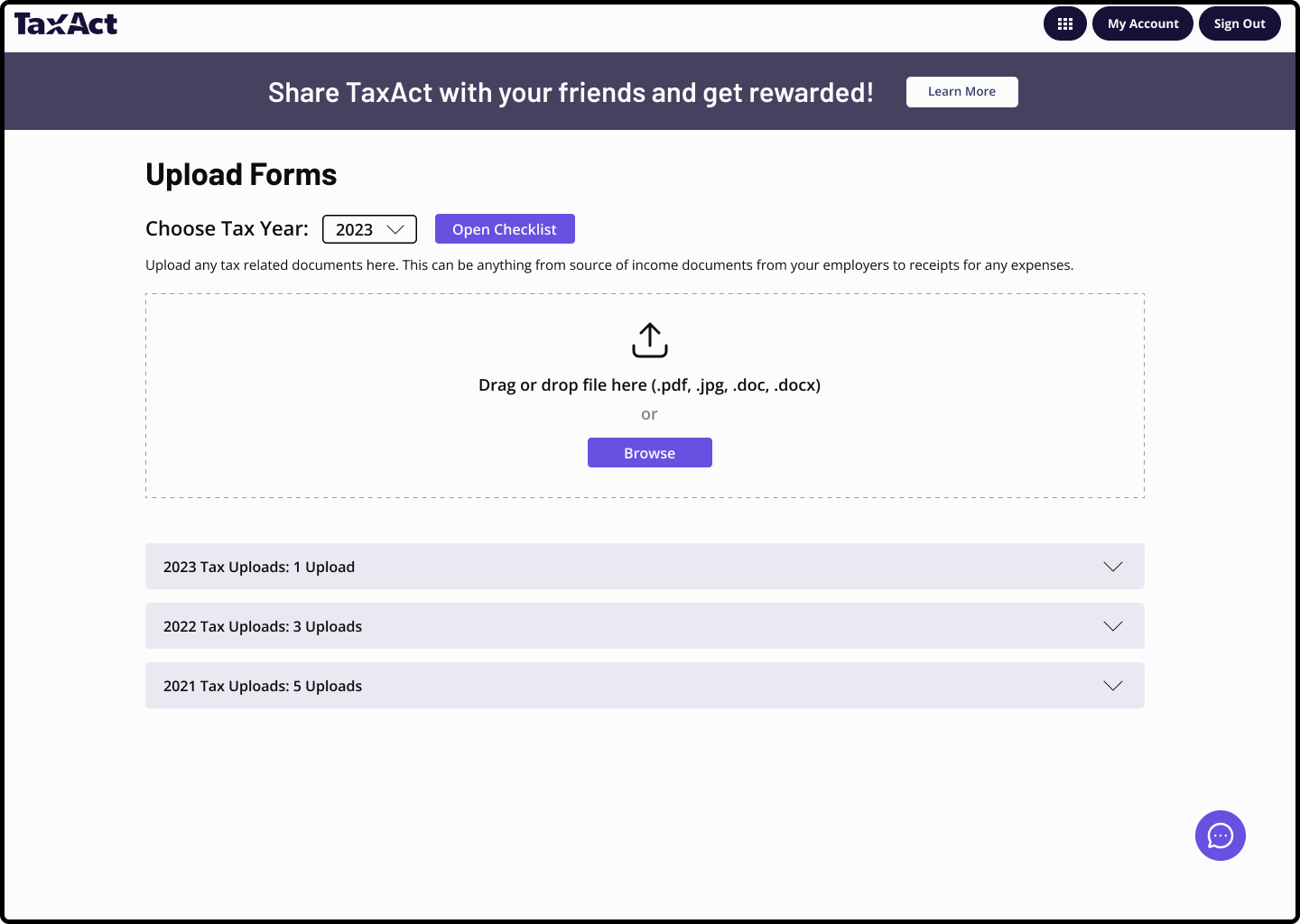

I conducted user testing with 8 participants from participants user interviews. They were instructed to complete 3 tasks:

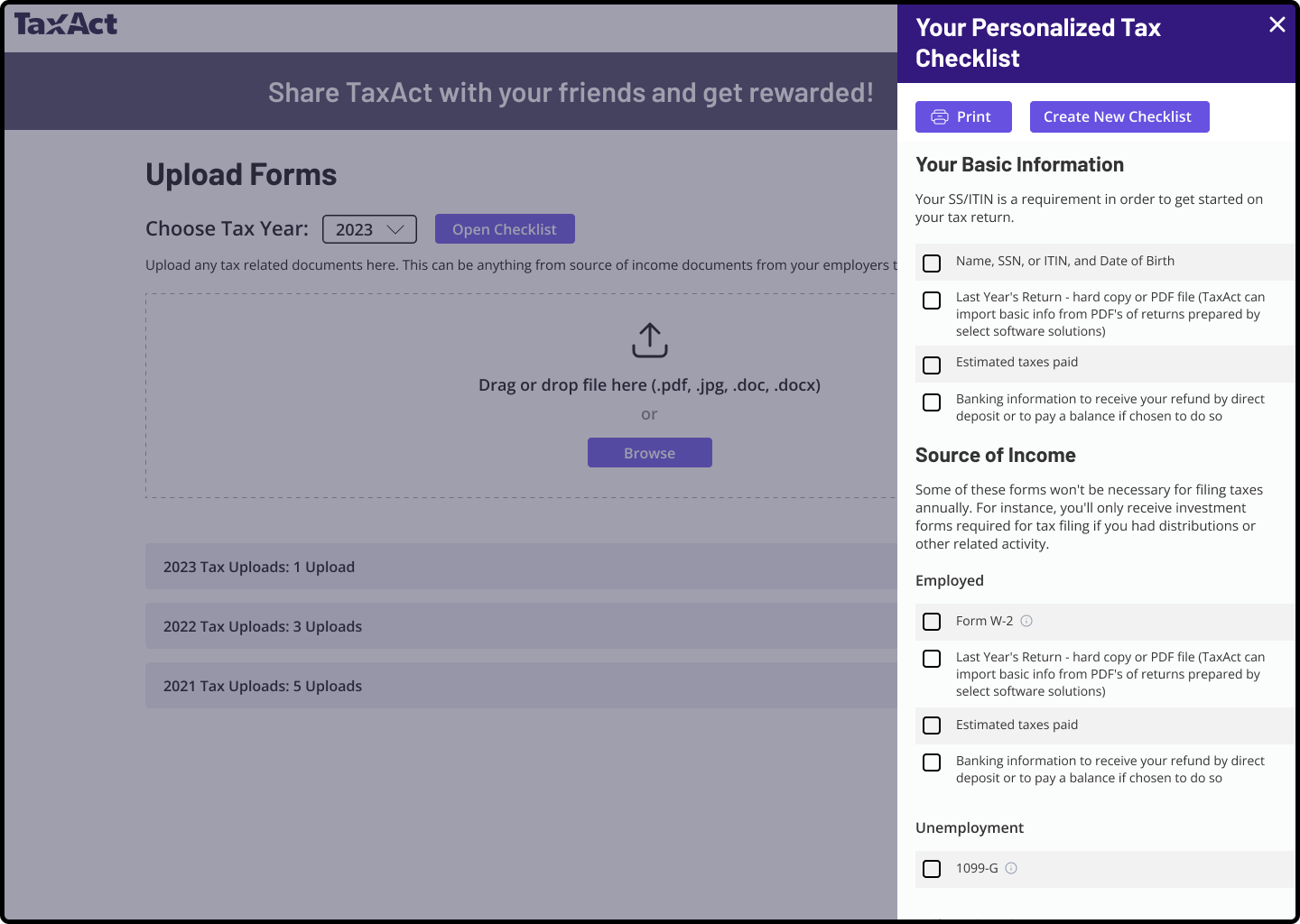

Create a personalized tax checklist

Upload tax forms into your account

Receive assistance from chat support

Test Objectives

Time Duration

The amount of time it took to complete tasks in a timely manner. Task completion would ideally take less than a minute.

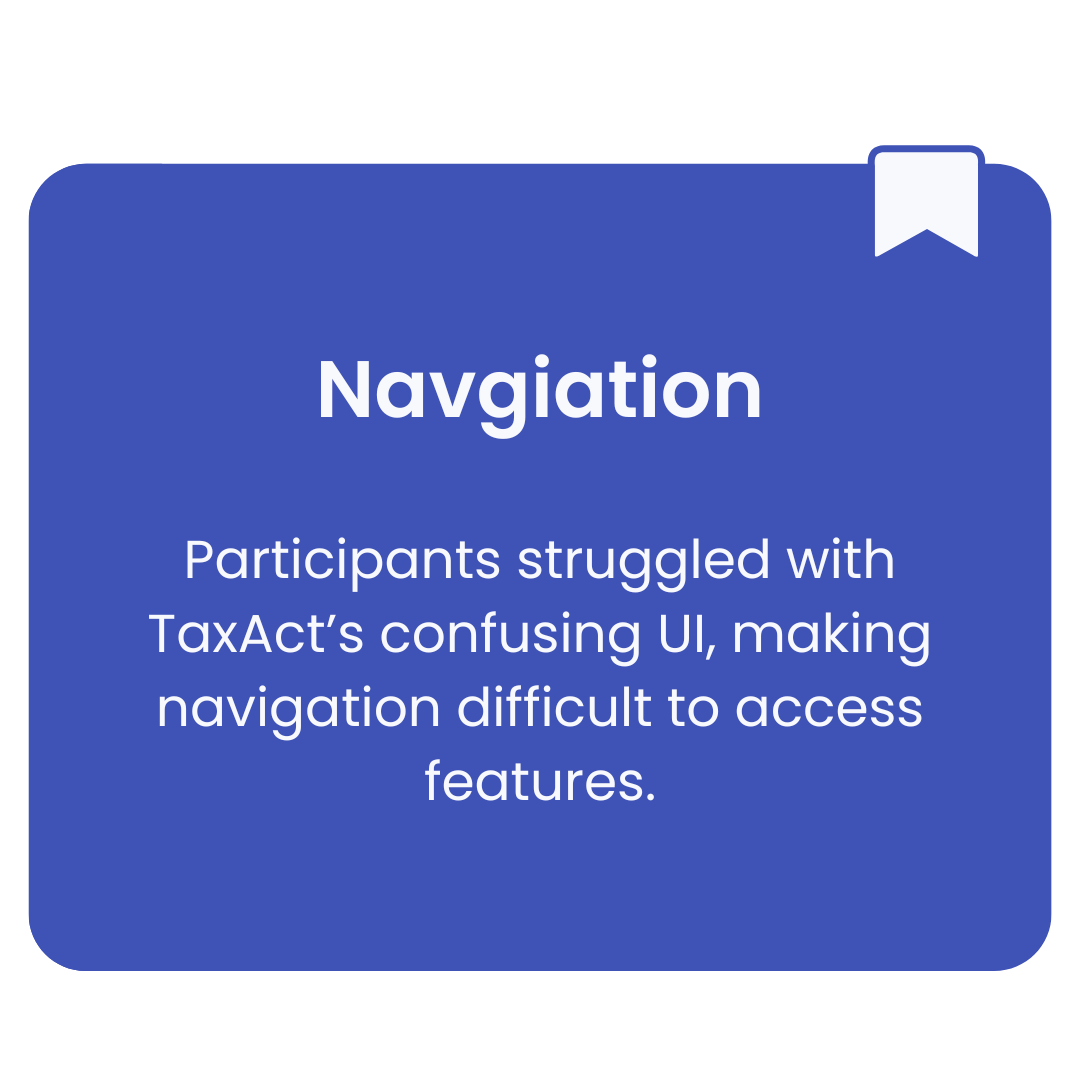

Navigation

Navigating the features beyond instructed tasks without anything confusing along the way.

Completion of Tasks

Completing tasks without any problems. Were there any confusing parts?

Usability

Are the features easy to access and understand? Are the participants familiar with each action?

Test Results

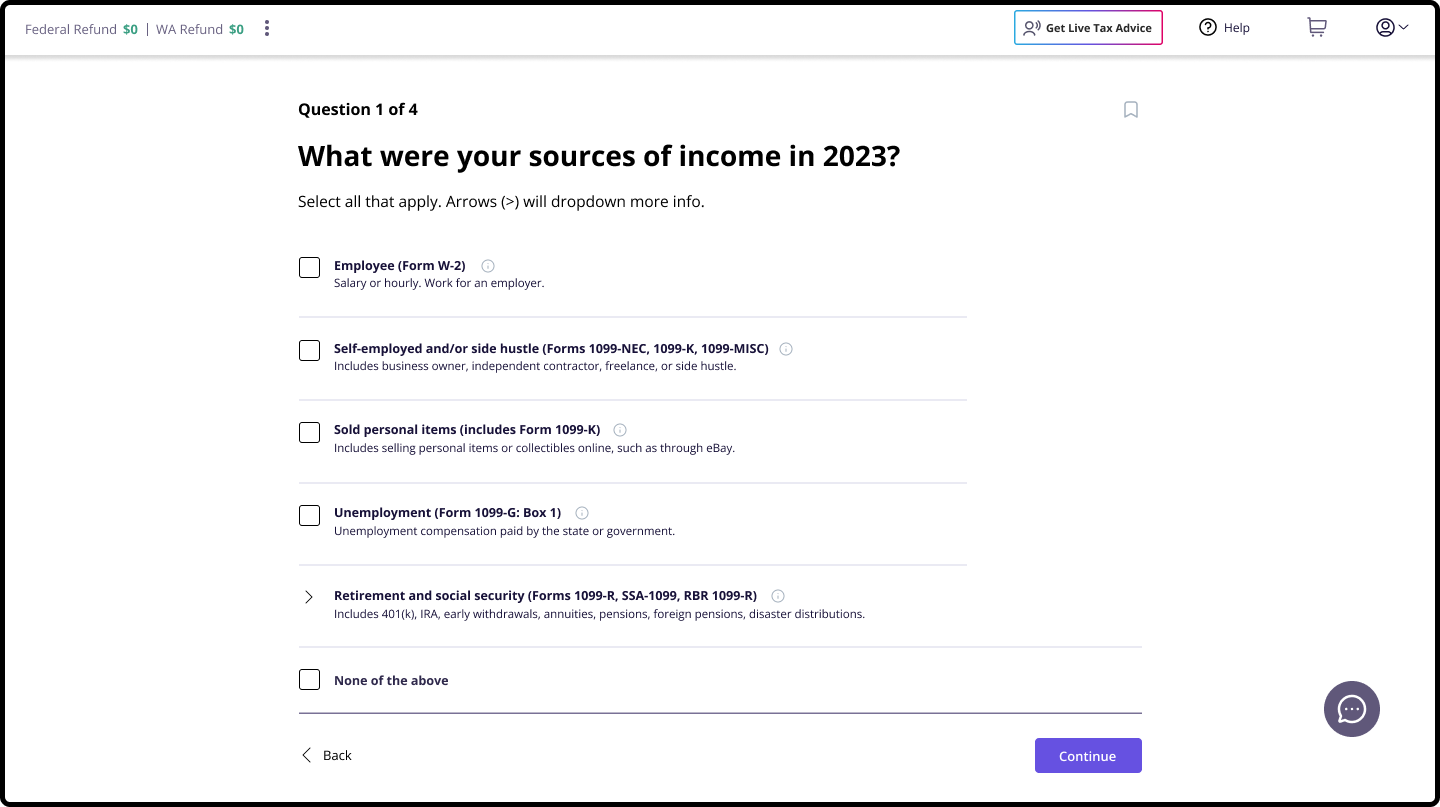

| ITERATIONS

Listen, Learn, Refine

Due to most of the participants unfamiliarity with TaxAct, there was a bit of a learning curve to access the added features. Below are prioritized iterations based on feedback from user testing.

Access to Support

Pain Point

Participants were confused on how to access chat support outside of their tax return, and often overlooked the support button. This confusion highlighted the need for improved visibility and accessibility of the chat support feature.

Personalized Checklist

Pain Point

When choosing the option to choose a full checklist made by TaxAct, users were confused on how to access the personalized checklist on this page.

Pain Point

Participants were confused what types of forms the checklist mentioned under each description.

Extra Addition

Participants wanted to access their personalized checklist alongside their saved uploaded forms. A sidebar was added to provide quick and easy access to the checklist.

Solution

Added the chat support button to be accessible throughout the entire prototype so that it is no longer limited within their return. Adjusted the button color to match TaxAct’s UI button color to make it more noticeable for users to access.

Solution

Added a personalized checklist button if users changed their mind, and added the support chat button for ease of access throughout site.

Solution

Added an info icon to provide detailed descriptions and where to find the forms depending on their situation.

The Final Product